India's Next Decade 🚀

I am Siddhant Davda! Welcome to the Building Dots newsletter💪

I will be sharing about startups building the future and also some insights about the Venture Capital industry.

India is on track to become the world’s third-largest economy by 2027, surpassing Japan and Germany, and have the third-largest stock market by 2030 as per Morgan Stanely’s report.

It is going to be India’s decade 🙌

India's per capita income is $2500 (INR 2,00,000) and China's $13000 (INR 10,40,000). So our per capita income is what China was around 2003. Between 2003 and 2018 China grew massively💰

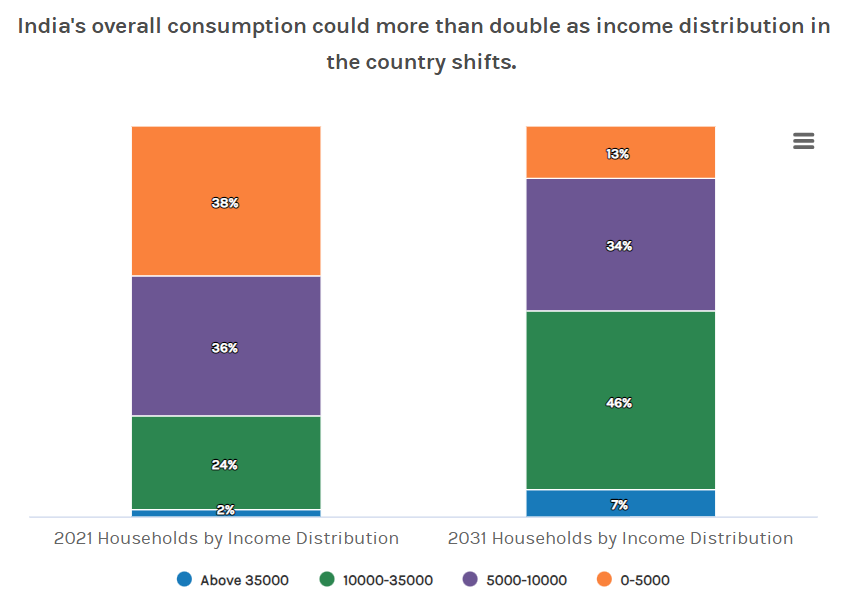

We will go from 1 in 4 households that are middle class and above to 1 in 2 households that are middle class and above. Thats like probably 200 million such households.

Indian consumers are also likely to have more disposable income 💵 The income distribution in India may change over the following ten years, and as a result, the country's overall consumption could very well more than double, from $2 trillion in 2022 to $4.9 trillion by the end of the decade —with the greatest gains going to non-grocery retail, including apparel and accessories, leisure and recreation, and household goods and services, among other categories.

Subsequently, expenditure allocated to essential commodities decreases. You might have heard of the concept of Giffen goods. It basically means when income rises people prefer higher quality goods over low quality. To illustrate, households with incomes less than $750 annually tend to allocate approximately 50% of their budget to essentials, which significantly decreases to around 30% when incomes surpass the $2,000 threshold, and contracts further to as low as 20% when the income level exceeds $10,000.

Also, a massive portion of global talent is in India. China's average age is 38 and India's is 28 👨🏻💻

And the outcome of that is that there will be fewer ‘dependent’ people in the country as a proportion of this working-age population. That also means that we’ll have a larger part of the population who can spend and drive consumption growth in the economy.

World inflation is 8.8% our inflation is 6.8% Our equity market cap is $3.5 trillion which is the 5th highest in the world 💸

In the USA there are 1 million retail stores and in India, we have 12 million retail stores. There are a massive number of entrepreneurs in India. Not the ones raising big funding but also these kinds of small entrepreneurs.

65 million small and medium enterprises of whom 70% are sole proprietors.

The formally organized workforce is 10% of the total workforce. (51 million of the organized workforce of 535 million) The rest are maybe entrepreneurs.

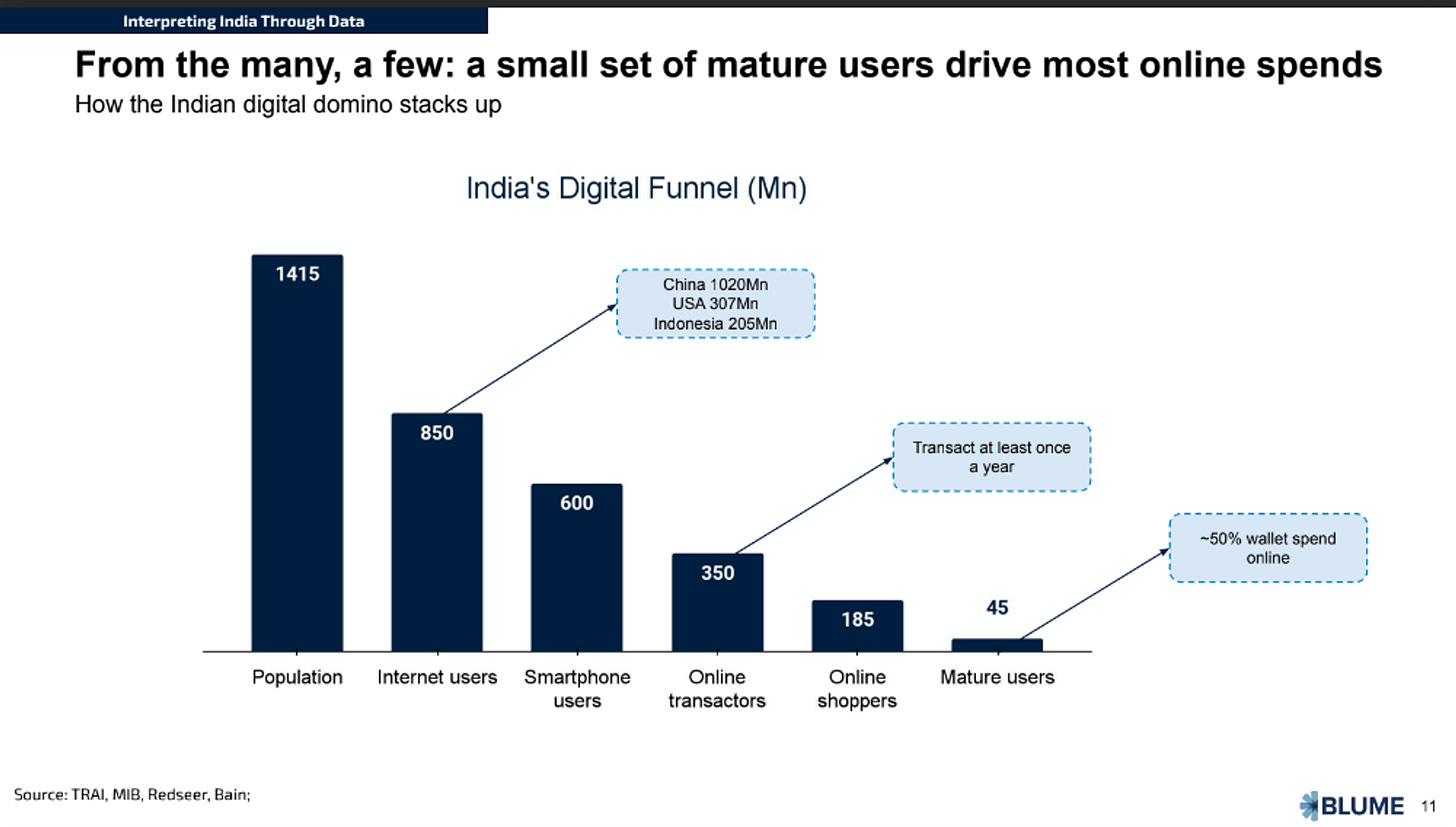

India has 850 mn internet users. China 1020mn, USA 307Mn and Indonesia 205Mn.

High internet users are because of low data pricing which is $0.17 per GB 📶 In the USA it is $5.62 and highest in South Korea at $12.55

But that’s not all there is another part to this as well!

Out of 850 mn, 600 mn are smartphone users. Only 350 mn users transact online once per year. 185M are online shoppers. 45 million are mature users who make up 50% of the wallet spend online.

Out of 600 million smartphone users 500 million use whats app. Imagine the level of penetration.

Except for whats app and youtube if you combine all other social apps the total market cap in India is $4.5 billion which is tiny.

Snap earned almost the same from ads with 600 million MAU.

Not only ads but anything that is consumer in India has a much smaller number than we imagined. Only 37 million unique mutual fund investors. 35-40 million unique credit card holders. Just 7.5% of Indian households have cars.

12% of India makes less than 1,30,000 a year. 50% of India makes between 1-4 lakhs a year. 33% make between 4-31 lakhs and 5% make above 31 lakhs

India 1 has 120 million people and contributes $1.4 trillion to GDP. India 2 has 100 million people and contributes $300 billion to GDP. India 3 has 1200 million people but contributes only $1.8 trillion to GDP.

So they are non-monetizable users. Most of the apps are now targeting India 1 because you need to acquire less number of users to get the same revenue because they spend more instead of trying to acquire India 3 and get the same revenue. CAC (Customer Acquisition Cost) will increase for India 3 because of more users.

Conclusion

But all in all, it is going to be interesting to watch India’s growth over the next decade. Think of a snowball rolling down a steep slope. It may begin as a small snowball, but as it travels, it continues to gather snow, growing larger and larger. It grows exponentially and has momentum on its side. Now imagine this happening to an economy. The economy expands and gathers momentum as a result of increased investments, production of goods and services, and disposable incomes. This snowball can't be stopped!

The unfolding chapters of progress will be nothing short of fascinating. Embracing this momentum, businesses and entrepreneurs have a golden opportunity to thrive in India's decade of boundless possibilities and unprecedented progress.

If you have any thoughts or questions share them in the comments :)

If you found this insightful, do drop a like and subscribe as it would mean a lot to me ❤️